Is blockchain truly decentralized? An in-depth analysis

Decentralization is a core feature and value of Blockchain technology.

Blockchain networks like Bitcoin, Ethereum, Tezos and the others, were designed to be decentralized and, on the surface, they appear to function that way. But how true is this in practice?

Some studies indicate that Bitcoin and Ethereum are experiencing a trend toward centralization. To reduce income volatility, many miners have joined large mining pools, resulting in a situation where a small number of these pools effectively control the blockchains.

In fact, there have been relatively few studies that effectively measure and compare decentralization across different blockchains.

In 2021, a scientific study titled «Measuring Decentralization in Bitcoin and Ethereum using Multiple Metrics and Granularities» was published with the goal of assessing and comparing the mining power of these two leading blockchains over the course of a year.

Let’s dive into it!

What is decentralization

Before we can measure the degree of decentralization in a blockchain, it’s essential to first define what we mean by ‘decentralization’.

Decentralization is not a mono dimensional concept.

In general, decentralization refers to the process of distributing control and decision-making across a broad range of entities, rather than concentrating it in the hands of a few.

In the context of Web3, decentralization can encompass various aspects, including:

- Mining/Minting power distributions: It measures the extent to which the process of adding a new block to the blockchain is decentralized.

- Geographic distributions of nodes: If most nodes are in the same country, the corresponding state could harm the network by forbidding the blockchain.

- Software decentralization: How many different implementations of clients, wallet, etc., are there ?

- Wealth distribution among actors: Some blockchains like Tezos use their native coin XTZ as a governance token for voting protocols upgrades. Centralization of wealth can lead to a centralization of governance.

- …

This is not an exhaustive list (For more information on this topic check this article).

Among all these decentralization metrics, mining/minting power is one of the most well-known and fundamental one. Indeed, a poor distribution of mining power can lead to the famous 51% attack which allows an attacker to take control of the blockchain, censor transactions, and even rewrite transaction history, enabling double spending.

Hence, the study we’re discussing today approaches the issue of decentralization from the perspective of mining power distribution.

Data

Most of the previous blockchain decentralization studies used to collect blockchain data produced during a relatively small-time span like a week. These results could only capture a momentary snapshot of decentralization, rather than its ongoing dynamics.

The study is based on blocks data produced during an entire year

To reveal long-term patterns and ongoing changes in the degree of decentralization, the study we’re discussing today based its measurements on data from blocks generated throughout the year 2019.

Using Google BigQuery, researchers retrieved:

- 54,231 Bitcoin blocks, from block 556,459 to block 610,690

- 2,204,650 Ethereum blocks, from block 6,988,615 to block 9,193,265

Metrics

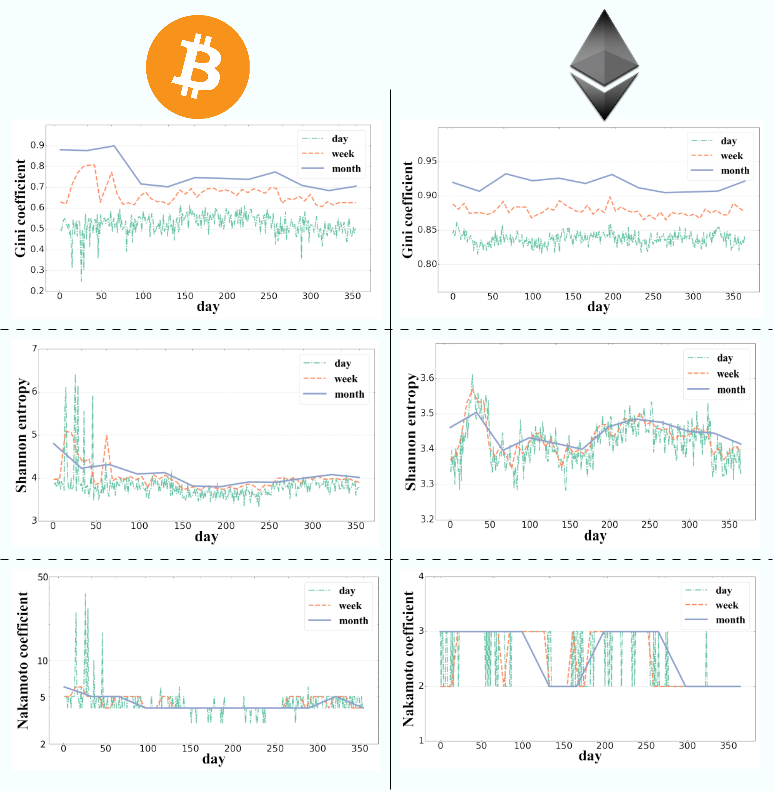

To quantify and compare decentralization, the study employed 3 different measurement metrics: Gini Coefficient, Shannon Entropy and Nakamoto coefficient.

Gini coefficient

The Gini coefficient is commonly used to gauge income inequality within population, but it can be used to measure the inequality of any distribution: such as the distribution of mining power among block producers.

The Gini coefficient ranges from 0 to 1. A Gini coefficient of 0 indicates perfect equality, meaning that each miner produced the same number of blocks during 2019 and thus has equal mining power.

Conversely, a Gini coefficient of 1 represents absolute inequality where a single miner produced all the blocks and other miners had no power.

Thus, the smaller the Gini Coefficient, the more decentralized the blockchain is.

Shannon entropy

The Shannon entropy is a concept of information theory that quantifies the average level of information, surprise, or uncertainty inherent in the possible outcomes of a discrete random variable.

In the context of this study, the Shannon entropy measures the degree of randomness and disorder in the distribution of blocks mined by miners. Researchers calculated each miner’s probability of winning the Proof of Work (PoW) challenge and adding a new block by dividing the number of blocks they validated by the total number of blocks produced. Shannon Entropy then assesses how evenly these probabilities are distributed among miners. A higher Shannon Entropy indicates a greater degree of randomness in the distribution of mining power, which suggests a higher level of decentralization.

Nakamoto Coefficient

Compared to the previously mentioned metrics, the Nakamoto coefficient is less abstract and more web3 focused. It is named in reference to the pseudonym of the individual or group behind the Bitcoin protocol.

It is defined as the minimum number of entities required to collude in order to control over 51% of the overall mining power. For example, if the Nakamoto coefficient of a blockchain is 10, it means that there are 10 entities (miners or mining pools) that can collaborate to execute a successful 51% attack and potentially take over the blockchain. Therefore, the higher this metric, the more decentralized the network is.

Granularity

The 3 metrics mentioned above must be computed from data produced over a specific time span. While the study could have provided values of these metrics based on all blocks produced during the year 2019, a more nuanced understanding of how mining power distributions vary over time was achieved by performing measurements across several time intervals. These intervals, referred to as “windows”, were analyzed at three different granularities: daily, weekly, and monthly.

3 granularities: day, week, month

This means that Gini coefficient, Shannon entropy and Nakamoto coefficient are evaluated for each day, each week, and each month of the year 2019.

In addition to the fixed window approach they initially implemented, they also used a sliding window to capture cross-interval changes and improve the precision. Indeed, the sliding window technique has enhanced the measuring of decentralization by revealing some volatility and extreme values that have been overlooked by fixed window-based measurement. However, both methods highlighted the same trends, and this is why in the next section we are only going to talk about results obtained with a fixed window. For more information about sliding window measurements, see the article.

Results

During the first 50 days, the degree of decentralization of Bitcoin, as assessed by all three metrics, tends to be higher and more volatile with numerous extreme values. However, for the remainder of the year, decentralization becomes lower and more consistent. In comparison, Ethereum exhibits greater stability.

However, according to these results, Bitcoin is clearly more decentralized than Ethereum:

- Gini coefficient: monthly, Bitcoin ranges between 0.7 and 0.8, whereas Ethereum consistently stays above 0.9.

- Shannon Entropy: Regardless of the time granularity, Bitcoin has a Shannon Entropy of approximately 4, while Ethereum’s entropy ranges between 3.3 and 3.5.

- Nakamoto Coefficient: Bitcoin’s Nakamoto coefficient oscillates mainly between 4 and 5 while Ethereum remains between 2 and 3.

Another interesting point is that the change of the measurement granularity does not significantly impact the overall trends of Shannon entropy and Nakamoto coefficient. However, the ranges of Gini coefficients vary considerably depending on whether they are measured daily, weekly, or monthly. The larger the time window, the higher the Gini coefficient. This is because a larger time interval can include more small miners who may only produce a few blocks. As a result, while the population of top miners remains constant, the number of smaller miners increases, leading to a higher Gini Coefficient.

Conclusion

This comparative study shows that the degree of decentralization in Bitcoin is higher, while the degree of decentralization in Ethereum is more stable.

These results might seem somewhat pessimistic, especially for Ethereum but keep in mind that this study has been realized in 2021 based on data produced in 2019. Since then, many changes have occurred in the Web3 ecosystem. These results should be considered in light of recent important events and upgrades, such as the Merge. One goal of Ethereum transition to PoS goal is to enhance decentralization by lowering the entry barriers for becoming a validator.

Moreover, as previously discussed, decentralization is not a monolithic concept solely related to mining power. Instead of viewing decentralization as a binary condition (decentralized/centralized), we should consider it as a multi-dimensional spectrum.

The question of how truly decentralized various blockchains are, remains an ongoing topic of discussion and analysis.

Is Blockchain really Decentralized was originally published in ekino-france on Medium, where people are continuing the conversation by highlighting and responding to this story.